The leadership team is a driving force for creating a high-performance culture and generating superior returns.

Contrary to conventional wisdom, getting the right CEO is not the most important organizational factor for success. The top concern is getting the right management team in place, including the right CEO.

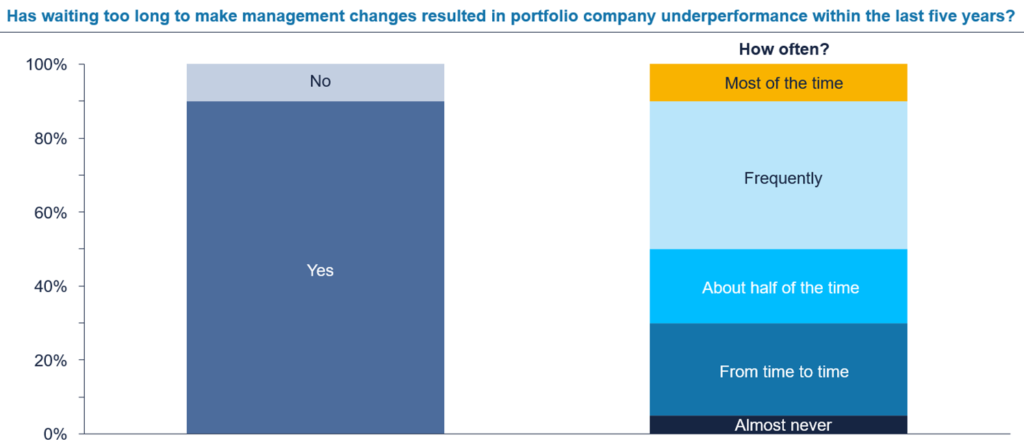

Astute investors realize that the combined competence of the management team is greater than the sum of its individual members. It’s one of the most powerful organizational factors that can “make or break” an investment. And, failure to act and make needed management changes early to enhance the team is the most common reason given for portfolio company under-performance (see Figure 1).

The way senior managers collaborate and augment individual strengths as a cohesive group is crucial for making good decisions and implementing the value creation plan at pace. Well-functioning leadership teams have a balanced set of skills and competencies to cover all the bases including strategic thinking, action-orientation, functional expertise, process know-how and sensitivity to people issues. In particular, excellent management teams will bring institutional knowledge to establish best-practice management processes in all functions to enable mediocre managers to move from good to great performance. Diversity is also important in order to ensure no blind-spots in dynamic markets and growth cases where good decisions require connecting-the-dots from many different angles. Diversity also helps to ensure that different levers of influence can be applied to diverse cohorts and roles. And the opposite case of a senior leadership team in conflict will leave the portfolio company dead in the water, without a compass and rudder.

Alignment of management team and private equity sponsor on value growth objectives and the governance are also critical prerequisites for success. It is puzzling how little time and effort is spent on explicitly aligning interests and mutual understanding between sponsors and management. A lot is left implicit. Getting fact-based transparency on the organization and management team in the first 100 days is a crucial foundation on which to develop trust and collaboration.

This article is part of our series on Organizational Excellence – Riding private equity’s third wave of value growth. Click here to read the introductory article and please subscribe below for future insights.

Resilience isn’t a buzzword anymore—it’s the make-or-break factor for portfolio companies navigating today’s volatility. That was the takeaway from the standout panel at the PE…

Read more

Rightsizing an organization is never easy. But, it is a normal process as firms adapt to changing market requirements. More recently, higher interest rates, AI…

Read more

The promise of AI and turbulence introduced by the Trump tariffs have renewed focus on rightsizing and efficiency improvement as levers for value creation and…

Read moreReceive our news and valuable perspectives on organizational effectiveness each month.