A chorus of top economists and investment gurus including Larry Summers, Ray Dalio, Nouriel Roubini, Jeremy Grantham, Cathy Wood and Mohamed El-Erian are sounding the…

Read more

Humatica is proud to announce that Valentina Pozzobon, a Director in our Zurich office, has been selected as one of eight expert judges for Private…

Read more

Excess liquidity has flooded private markets and reduced the number of easy targets in private equity. Investors are now competing for ever smaller arbitrage opportunities…

Read more

Humatica, the leading private equity specialist advisor for portfolio company organisational effectiveness, has advised Elysian Capital on its investment in Gravity Global. Gravity Global is a digital marketing business serving…

Read more

Humatica, the leading private equity specialist advisor for portfolio organizational effectiveness, is proud to announce four promotions in its London and Zurich offices. Paul Simpson…

Read more

We are proud to announce that following our record growth in 1H 2021, Humatica has moved to new and larger offices in central London. Andros…

Read more

Valentina Pozzobon, a Director and Board Member of Humatica, the leading private equity specialist advisor for portfolio company organisational effectiveness, will take a full-time role…

Read more

In the new episode of the alpha Talks Podcast, Enno Krey speaks to Dr. Thomas Costa, former CEO of Coventya (acquired by MacDermid Enthone in…

Read more

Humatica, the leading private equity specialist advisor for portfolio company organisational effectiveness, has advised HVD Partners on its acquisition of Sampsistemi S.r.l (SAMP). Founded in…

Read more

A side-effect of full-priced markets and the industrialisation of private equity is funds looking to upgrade and standardize their deal processes – the way they…

Read more

Humatica Managing Partner Andros Payne interviews Joost Heeremans, Partner at Gilde Buy Out Partners, and Stijn Vos, CEO of ESDEC, about the lessons learned during…

Read more

In the latest episode of the alpha Talks Podcast, Enno Krey speaks to Jouni Heinonen, Managing Partner of HVD Partners, a service provider that helps…

Read more

What is your position and what do you do on a day-to-day basis? I am a consultant at Humatica. There is no such thing as…

Read more

Making good investment choices is getting harder With more institutional money in the market and the industrialization of private equity, the number of attractive opportunities…

Read more

The Practical Guide for Private Equity Professionals and Senior Executives Humatica’s latest whitepaper “Buy & Build: Secrets of Success” features the critical lessons learnt that…

Read more

Humatica, the leading private equity specialist advisor for portfolio company organisational effectiveness, has advised Baird Capital’s private equity team on its investment in Azzur Group. Azzur is a provider of professional…

Read more

The fund landscape is changing, creating more winners and losers in an increasingly polarised ecosystem. The pandemic and long-term megatrends are forcing strategic and competitive…

Read more

Once a top-level target operating model and organization are agreed, that’s when the heavy lifting starts. It’s when hundreds of decisions on sub-structures, new or…

Read more

Most managers and employees view a merger or acquisition with fear and suspicion. They see it as a zero-sum game, where one party wins at…

Read more

Humatica, the leading private equity specialist advisor for portfolio organisational effectiveness, has advised private equity firm Freshstream on its investment in a group containing the UK’s leading security technologists, including SmartWater® and Perimeter…

Read more

SPACs are a new phenomenon that further blurs the line between public and private markets. They are putting more pressure on private equity funds to…

Read more

Defining the post-merger operating model is an essential step after a bolt-on acquisition including what functions and activities should be merged, and which should not.…

Read more

Despite the pandemic, Humatica had a record 2020. We completed 31 international projects, 23 of which were delivered remotely. We worked closely with our loyal…

Read more

Humatica, the leading private equity specialist advisor for portfolio organisational effectiveness, has advised private equity firm Intermediate Capital Group (ICG) on its investment in Lucid Group. Founded in 2007, Lucid Group is a…

Read more

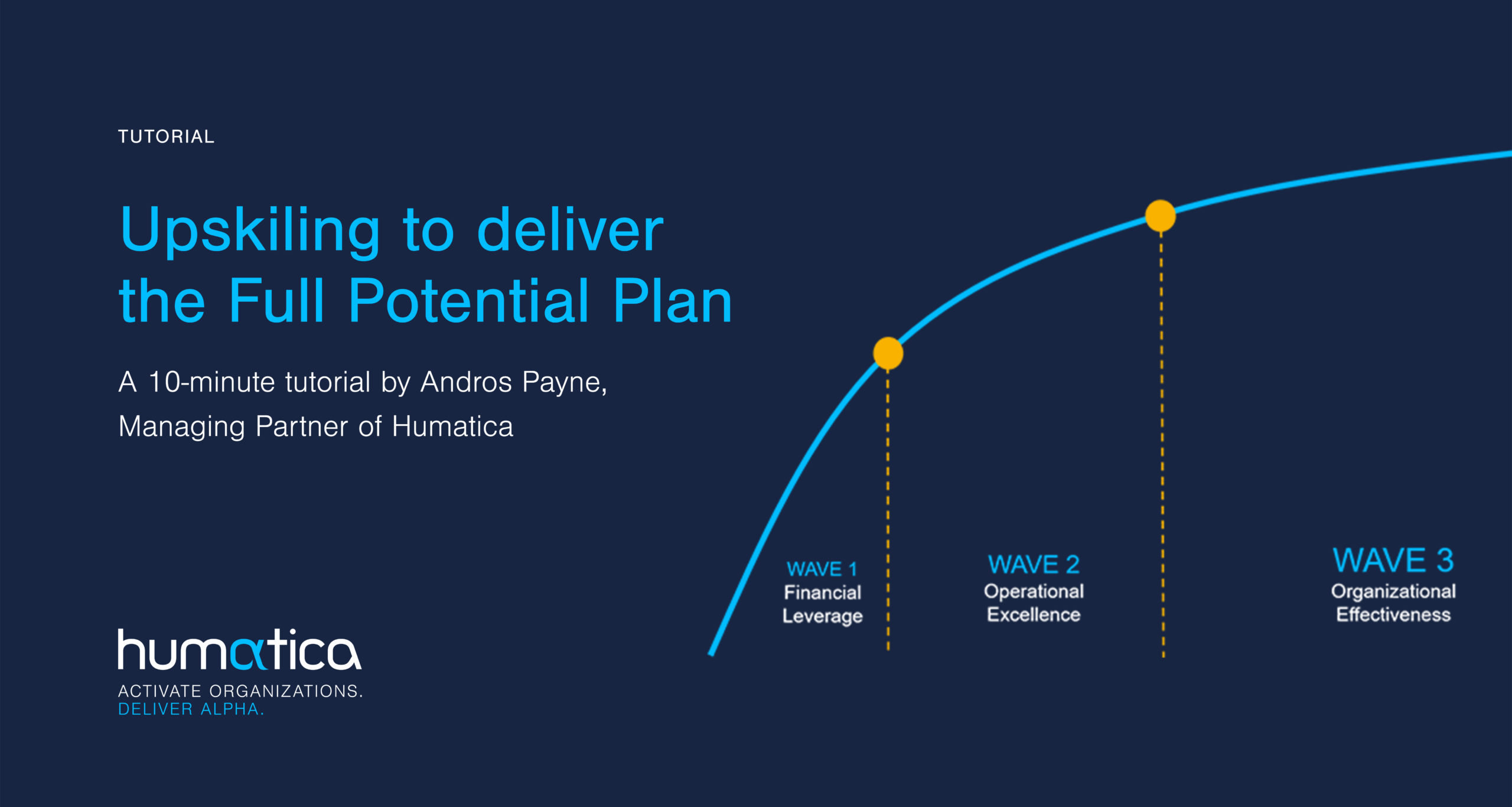

What got you here, won’t get you there. With deal prices on the rise, funds need work harder and take bigger risk to realize superior…

Read more

Humatica recently interviewed Jouni Heinonen, the managing partner of HVD Partners on their sale of Solifos AG to NBG GmbH. HVD Partners carved out the…

Read more

Defining a target operating model “TOM” is an essential first step following a bolt-on acquisition. It sets the organizational framework for the future management structure…

Read more

One of the consequences of more competitive deal markets and more money in private equity is the increased use of consultants – not only pre-deal…

Read more

97% of deal makers agree that organizational issues are the greatest source of deal risk. Ask any dealmaker what determined their best and worst deals…

Read more

In an increasingly competitive deal market, private equity firms are more and more turning to Buy & Build strategies to realize superior returns on their…

Read more

Andros Payne has joined the first episode of the alpha Talks podcast. He speaks about organizational effectiveness and explains how private equity funds can use…

Read more

Private equity has consistently outperformed public markets. In the past this was attributed to more aggressive capital structures and strongly aligned management incentives. However, with…

Read more

Humatica, the leading private equity specialist advisor for portfolio organizational effectiveness, is proud to have supported HVD Partners and the Solifos AG management with the…

Read more

Is your Sales Force ready for digital sales? As 2020 draws to a close, corporate leaders are looking back over the last months since COVID…

Read more

Humatica is featured in The Times of London on restructuring for future growth during COVID. The Raconteur supplement on Business Restructuring addresses key aspects on the…

Read more

It happens too often. Firms start an ERP implementation. After vendor selection and latest during process requirements definition, they realise that the new system will…

Read more

Humatica, the leading private equity specialist advisor for portfolio organisational effectiveness, has appointed Enno Krey as the firm’s Digital Products Lead based in London. This…

Read more

Even in COVID times, bolt-on acquisitions are an important lever of value growth for private equity. However, they are tricky to execute, especially with former…

Read moreHumatica, the leading private equity specialist advisor for portfolio organisational effectiveness, is proud to announce four promotions in its London office. Abhash Bhattacharya (Dutch/Indian), who…

Read more

COVID-19 is causing unprecedented upheaval in the travel industry. In particular, business travel has seen a steep decline driven by lockdown constraints and the emergence…

Read more

Sponsors pull their hair out trying to reform the governance of previously family-run businesses. Clearly, there are many successful ones, including Swarovski, Mars and ALDI.…

Read more

Humatica, the leading private equity specialist advisor for portfolio organisational effectiveness, is proud to announce its cooperation with DotProjects to offer Humatica’s services and local…

Read more

Humatica, the leading private equity specialist advisor for portfolio organisational effectiveness, has advised private equity firm Baird Capital on its acquisition of a majority interest in eCube Solutions Limited, a leading aircraft disassembly…

Read more

Clive Booth of the ESG Foundation interviews Andros Payne on the corporate governance practices that underly sustainable value creation – the ‘G’ in ESG. We…

Read moreIn this 10 minute interview for Catalysis Advisory, Andros Payne of Humatica answers three important questions: What’s driving increased PE focus on non-financial, organizational issues in…

Read more

COVID-19 is forcing accelerated digitalisation of B2B sales with far-reaching consequences for Sales organisations. The rationale for on-site “sales calls” to understand customer needs and…

Read more

COVID-19 has taught us a lot about the organisational structures and new operating models of the future. One lesson is how much can actually be…

Read moreHumatica, the leading private equity specialist advisor for portfolio organisational effectiveness, is proud to announce its cooperation with Icknield Ltd., a leading UK restructuring and…

Read more

Many are speculating about what lasting organisational changes will result from COVID-19. Everyone is sure that social distancing will have an impact on how we…

Read more

As the fall-out from COVID-19 threatens to sink entire portfolios, PE sponsors and CEO’s need to walk a tightrope between preserving organisational capabilities in order…

Read moreHumatica, the leading private equity specialist advisor for portfolio organisational effectiveness, is proud to announce five promotions in its London and Zurich offices. Valentina Pozzobon…

Read more

Humatica, the leading specialist private equity advisor focused on organisational effectiveness, has appointed Jaroslav Filak as a Consultant in its Zurich office. Jaroslav will support…

Read more

At a time of heightened uncertainty, AI is creating even more future shock. Leading scientists, including the late Stephen Hawking warn that if left unchecked,…

Read more

Congratulations to the Humatica team for another record year of growth. We have had the privilege of serving some of the most demanding private equity sponsors…

Read more

Humatica is proud to be sponsoring the PEI Operating Partners Forum Europe 2020 in London on 5-6 October. The event will be held at the…

Read more

Humatica is proud to have become a member of the British Private Equity & Venture Capital Association (BVCA). The BVCA is the industry body for…

Read more

The collective ability of an organisation to anticipate change, opportunities and risks, and move faster than the competition drives sustained value creation – the winning…

Read moreHumatica is proud to be sponsoring Real Deals Value Creation Conference 2020 in Munich on 24 September. The event will be held at the Courtyard…

Read more

Markets, competition and customer preferences are shifting faster than ever. The disruptive economics of information is challenging new and established businesses alike. No wonder leaders…

Read more

As a long-time contributor to RealDeals magazine, Humatica was asked to write a piece on the future of private equity – a rare opportunity to…

Read morePRESS RELEASE Zurich, 29th August 2019 Andreas Knobloch strengthens Humatica team in Germany Humatica AG has appointed Andreas Knobloch as a senior member…

Read more

Companies are reorganising more frequently than ever before. It’s a natural consequence of a more dynamic market environment and higher management turnover. Jack Welch famously…

Read more

As value creation plans have become more aggressive, the rate of CEO turnover has increased. Sponsors have less time and patience. But fire and hire…

Read more

In the June issue of Real Deals, the HumaticaCorner focuses on how some funds are turning new compliance requirements to their advantage for improved governance.…

Read moreHumatica AG was retained to advise Capvis on its majority investment stake in Xovis, the global leader in people flow measurement and analytics. With the…

Read more

Congratulations to the Humatica team for completing their 260th project to improve organisational performance and value – providing specialized services for private equity backed companies,…

Read more

Alvin Toffler, an American futurist, wrote his global best seller “Future Shock” in 1970 describing the effect of new technologies on business and society. His…

Read more

Humatica Ltd. has moved to new premises in the heart of Mayfair, located on the corner of Hanover Square and Harewood Place. The new office…

Read more

Digitalisation is one of the hottest topics in private equity today. The disruptive effect of the technology can render a good investment obsolete or enable…

Read more

Humatica Ltd. was retained to advise the Riverside Company on its significant investment in E&A Scheer (Scheer), the largest global blender and vendor of premium…

Read more

Humatica AG was retained to advise Summa Equity on its majority investment in Infobric AB (“Infobric”), a provider of software and hardware for attendance systems,…

Read more

The real test of a management team comes when they need to quickly shift from growth to cost reduction. This day of reckoning may soon…

Read more

PE executives are stuck between a rock and a hard spot. Pressure to drive company performance has increased with prices. On the other hand, the…

Read more

Humatica Managing Partner Patrick Mina has been interviewed for the October issue of Finance Monthly. Read full article

Read more

Over 70% of CEO’s are replaced during the holding period – one more indication of today’s challenging value creation plans and competitive deal markets. However, the…

Read more

Humatica AG was retained to advise Summa Equity on its majority investment in Lakers Holding AB (“Lakers”), a Nordic group operating within the water, wastewater,…

Read more

Humatica has supported Solifos AG’s management and HVD Partners with the carve out and rapid turn-around of the former Brugg Cables company active in fiber…

Read moreA letter from the founder This month marks our 15th year serving private equity investors and portfolio company management teams. In an otherwise turbulent business environment…

Read more

Humatica AG was retained to advise Capvis on its majority investment in Austrian firm AMANN GIRRBACH AG, a pioneer in dental CAD/CAM technology. The firm…

Read more

Apple recently became the most valuable public company, breaking through the $1Tr. mark. How is it possible that a firm in the hyper-competitive consumer electronics…

Read more

Humatica Ltd. was retained to advise Baird Capital on its acquisition of a majority interest in Collingwood Lighting, a leading designer and supplier of residential,…

Read more

Humatica Ltd. was retained to advise the Riverside Company on its investment in Swiss manufacturer TECSEDO RE through Panels S.A., a portfolio holding of The…

Read more

As the PE industry matures and successful deals get trickier to execute, ESG guidance becomes more important. Compliance requirements are logically tightening all around. This…

Read more

At the recent PEI Operating Partners Forum Europe, there was consensus: organisational effectiveness and talent management are the foundation for implementing all value creation levers.…

Read more

Please click on the link to view full Press Release Humatica supports Partners Group and Capvis

Read more

Systems implementation is notorious for high project risk and failure to deliver anticipated benefits. In particular, private equity, with its limited timeline for investment, struggles…

Read more

With EBIT multiples reaching uncomfortable heights, there is no room for error in executing the value creation plan. And, management drives the pace. This month’s…

Read moreDigitalisation is disrupting business. But it is having an even more profound impact on organisations, behaviour and leadership. Rudimentary activities are being made redundant, and AI…

Read more

What got you there, won’t get you there Hyper-competitive deal markets and full-prices are changing the rules of the game. Private equity sponsors and portfolio…

Read more

Humatica Ltd. was retained to advise the Riverside Company on its investment in Alter Pharma, a Belgian pharmaceutical group. Alter Pharma distributes EU-sourced pharmaceutical products…

Read more

One approach to boost yields is to target more complex, difficult situations. Corporate carve-outs often fit the profile. However, releasing value doesn’t come easy. Extracting…

Read more

The last year has seen a number of high-profile corporate carve-outs come to market. In a competitive buyout industry, private equity firms have been eager…

Read more

Times have been good for private equity since the global financial crisis in 2009 – eight years of steady growth and easy money. However, dealmakers…

Read more

Humatica´s next Organisational Excellence breakfast seminar will take place at The Ritz Hotel, London, on 27th September. A lively discussion on “Identifying organisational bottlenecks post-signing…

Read moreMore funds are appointing specialised Operating Partners to help align portfolio company organisations for value growth. However, the emerging role is not yet well defined…

Read more

Increased competitiveness and technology are driving “always-on” availability of deal makers. However, is this a good thing? Humatica was recently quoted on the topic in…

Read more

Humatica Ltd. was retained to advise Baird Capital, on its recent investment in Prescient Healthcare Group. Please click on the link below to view the…

Read more

Managing Secondaries – The good, the bad and the ugly Secondaries are more commonplace. However, a change of ownership from one PE house to the…

Read more

Over 50% of buy-out CEOs don’t get to see an investment all the way through. And, in private equity, the trend to replace senior executives…

Read moreIn the latest RealDeals Guest Comment article, Andros Payne, discusses learning the secret of how successful operating partners drive change without formal authority… Read full…

Read more

Based on a request from Limited Partners and General Partners, Humatica initiated an ambitious study to understand the current state of the art in organizational…

Read more

Operating Partners have the most difficult job in Private Equity. They should facilitate transformational change post-deal, but without formal authority. Our experience shows that those…

Read moreA lack of economic growth despite record low interest rates, rising populist discontent and mounting unfunded pension liabilities in the developed economies: they have the same…

Read moreWith record private equity assets under management and US$1.3 trillion of dry powder, insiders are nervous. How will this money be deployed and generate a…

Read more

Humatica has been an advocate for a more assertive PE investment approach focusing on leadership and organisational performance since 2003. In this month’s InFocus HR guru Dr.…

Read more

Women are running four of the world’s top democracies and with Hillary Clinton, may soon be running the fifth. Times have changed indeed. The ideals…

Read moreStandards and compliance requirements are increasing everywhere. However, the essential leadership processes for making and implementing decisions to grow value are often left to each…

Read more

Most people avoid conflict. It’s anti-social. However, sometimes this gets in the way of making good business decisions. This month’s InFocus features a recent interview with Ray Dalio,…

Read more“A well executed reorganisation can be one of the most liberating events in a company’s history, releasing power and talent”. In the latest edition of…

Read more97% of private equity investors confirm that personnel issues are a key reason for not achieving targeted IRR. Clearly, sponsors need more transparency in this…

Read more

“Specialisation runs out of steam when you can’t connect the dots on patterns of risk or opportunity, which is really what private equity is all about,” Read…

Read more

Humatica is proud to announce that it will be sponsoring the Private Equity International Operating Partners Forum Europe 2016. The event will be held at…

Read more

Patrick Mina has joined Humatica as its new Managing Partner UK. Patrick is responsible for managing Humatica’s operations in the UK and is active on…

Read more

Private equity has grown in scale and maturity, with multi-billion funds having hundreds of employees and offering diverse financial services. In an era of diminishing…

Read more

Hiring the right people is frustratingly difficult. The number of dimensions on which there needs to be a fit are large. Some can be tested…

Read moreHiring the right people is frustratingly difficult. The number of dimensions on which there needs to be a fit are large. Some can be tested…

Read more

A recent article on growthbusiness.co.uk discusses the results from Humatica’s new study “The Third Wave: Organisational due diligence – Riding the next wave of value…

Read more

New Humatica Research Too many funds. Too much liquidity. Too high deal prices. Fund managers are asking themselves what’s next after Operational Excellence? How will…

Read more

In the October issue of Acquisition International Humatica consultant Valentina Pozzobon discusses how organisational due diligence can be incorporated successfully into business deals. “Considering merger…

Read more

Despite huge efforts to improve operational processes over the past 20 years, critically important management processes are left up to the discretion of each manager…

Read more

In an article published in last week’s issue of RealDeals Humatica’s Andros Payne explores what the Volkswagen value collapse says about knowledge worker behaviour, productivity…

Read more“GPs know that it is important to bring operational capabilities to their deals if they want to make stellar returns. But in overlooking the importance of soft factors they are missing out…

Read more

Volksvagen | VW Now, with the benefit of hindsight, it is a stupid surprise. How is it that a group of employees at VW could…

Read more

The transition into a new executive role in private equity is tough. The performance demands and rigour of private equity’s active governance model can be…

Read more

Humatica is one of the proud sponsors of RealDeals’ European Mid-Market conference at the Renaissance Amsterdam Hotel on the 23rd of October 2015. Join us…

Read more

It is notoriously difficult for new buy-out CEOs to make the jump to private equity. The skills and competencies required to fulfil rigorous performance requirements are…

Read more

In the industry report “The Private Equity Job Market Is Hot In 2015” Valerie Thompson investigates how big the current war for talent in Private…

Read moreOperational processes have been re-engineered to perfection over the past 20 years. However, management decision-making processes that sit above them, are still left up to individual…

Read more

About the Interviewee NORMAN WALKER is an advisor to TPG Capital for portfolio company organisational and leadership issues. He leads his own firm Ardfern AG,…

Read more

Dr. Ulrich Bergmoser, Partner at Humatica, presented at the “European Restructuring Day” to more than 200 refinancing and restructuring experts, corporate executives, top management representatives…

Read more

Private equity’s governance structure places unique and high demands on senior executives. They are at the fulcrum of the capitalist system, balancing the requirements of…

Read more

Dr. Ulrich Bergmoser has joined Humatica in the capacity of Managing Partner DACH. He is based in London and has more than 20 years of…

Read more

The latest issue of RealDeals magazine features an article on how a mid-market buy-out increased enterprise value 3x by shifting culture over the course of…

Read more

All the easy levers have been pulled – purchasing cost reduction, a new strategy – so what’s next? Private equity sponsors are increasingly looking at…

Read more

What are the real reasons for roughly half of all mergers failing to generate their cost of capital? In the latest edition of Acquisition International…

Read more

Getting the culture right is critical for merger success. The greatest risk for failure is culture clash, a breakdown of trust, and the resulting stagnation. Merging…

Read more

Humatica is one of the proud sponsors of Unquote’s Nordic Private Equity Forum at the beautiful Grand Hotel, Stockholm, on the 5th of May. The…

Read more

Private equity leaders are faced with a massive challenge – how to grow revenues and value in slow-growth markets. Shifting white-collar productivity and improving behaviour…

Read more

The survival rate of private equity portfolio company CEOs is shockingly low. And the cost of changing the CEO in terms of lost time, effort and…

Read more

In the latest edition of Real Deals magazine Humatica’s Andros Payne contributes with his views on why the half-life of private equity-backed chief executives is…

Read more

We are honoured to announce that Humatica has been shortlisted for the prestigious Private Equity Awards 2015. As a result of our extensive work with…

Read more

Norman Walker, Humatica’s new Advisory Board member, is an advisor to TPG Capital for portfolio company organisational and leadership issues. He also leads his own…

Read more

Individual performance feedback is one of the toughest management processes to get right because it runs against the basic human nature of social interaction in…

Read more

Humatica’s CEO, Andros Payne, contributes his thoughts to the latest Merrill DataSite white paper on value creation across the private equity life cycle. Read the report…

Read more

Recent issue of PEI Operational Excellence: Keynote Interview with Erik Osmundsen, CEO of Altor’s portfolio company NorskGjenvinning and Andros Payne, Humatica The success of Altor’s…

Read moreHumatica has strengthened its team with the addition of Reine Wasner. Reine brings deep consulting and line management experience. He was previously the head of…

Read moreOver 300 UK private equity investors and experts convened at the prestigious Landmark Hotel in central London. They discussed a range of topics fundamental to the…

Read moreHumatica has completed 2013 with another year of profitable growth. Although the firm does not publish financial figures, Andros Payne commented, “We have had an…

Read moreIn today’s fast–moving markets, value creation comes from an organisation’s ability to collectively anticipate change, says Andros Payne, CEO of Humatica. More than a century…

Read morePrivate Equity International has chosen Humatica as a selected sponsor of its flagship European event for private equity operating partners. With over 100 attendees for…

Read moreHumatica celebrated 10 years of profitable growth with a gathering of past clients, friends and partners in a private dinner at Zurich’s exclusive Hotel Widder.…

Read moreHumatica hosted a private dinner with leading investors on the topic of “Getting the organisation right”. Participants from leading funds, including Advent International, 3i, Elysian,…

Read moreAndy Cook has joined Humatica in the UK to strengthen the senior team and drive further expansion of work in the United Kingdom. Andy joins…

Read moreErhalten Sie jeden Monat Neuigkeiten und wertvolle Perspektiven zu Themen der organisatorischen Effektivität