As the PE industry matures and successful deals get trickier to execute, ESG guidance becomes more important. Compliance requirements are logically tightening all around.

This month’s InFocus features a recent Humatica article on how some funds are leveraging best-practice Governance to create superior returns.

Private equity investors and executive teams rightly focus on operating model design as a core lever for value creation. The right structure can accelerate growth,…

Read more

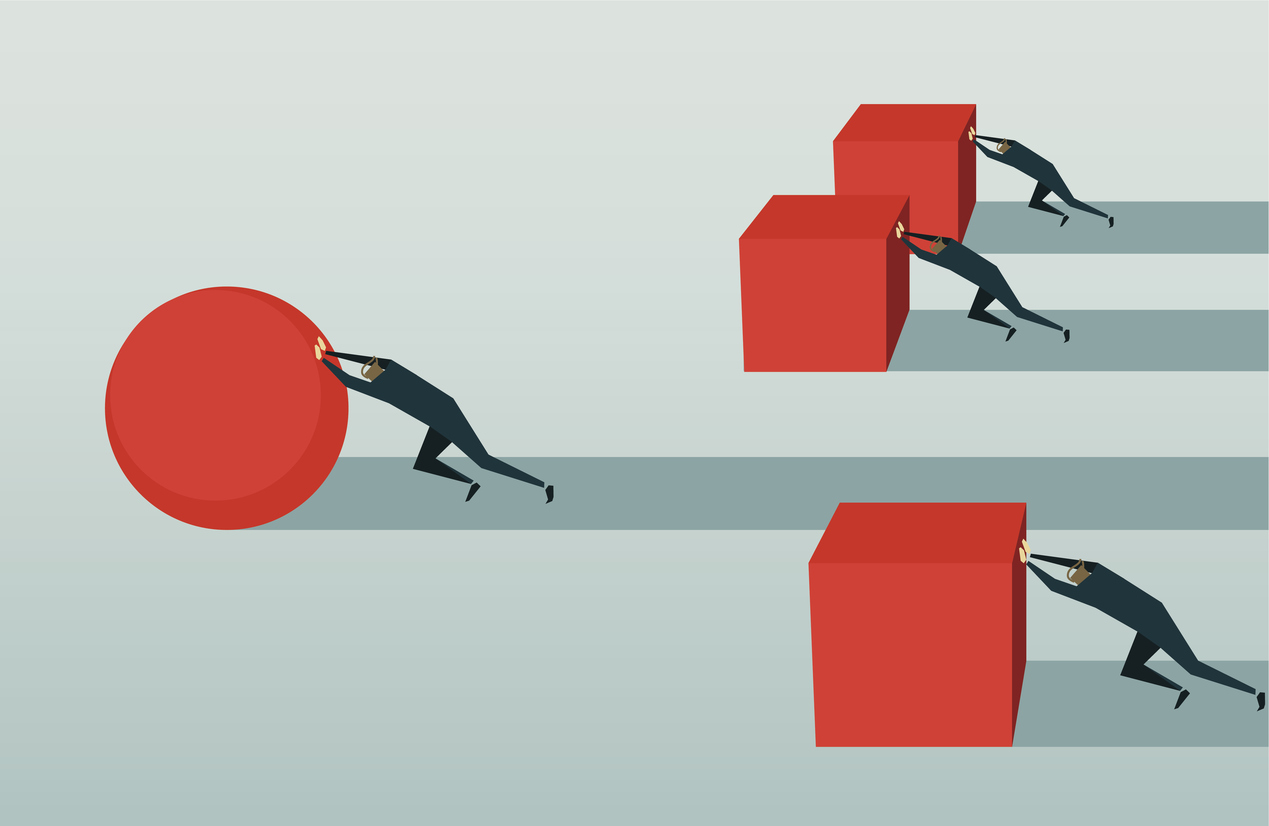

In many organizations, strategy promises growth, efficiency, and innovation—but day-to-day execution tells a different story. Decisions drag. Silos persist. Accountability blurs. Leaders work harder without…

Read more

In today’s private equity landscape, the classic levers of value creation are no longer enough. As markets evolve and competition intensifies, governance is emerging…

Read moreErhalten Sie jeden Monat Neuigkeiten und wertvolle Perspektiven zu Themen der organisatorischen Effektivität